Introduction to Life Insurance and Medical Exams

What Is Life Insurance?

Life insurance is a safety net—plain and simple. It provides financial support to your loved ones if something happens to you. You pay a premium, and in return, the insurance company promises to pay a set amount (called the death benefit) to your beneficiaries when you pass away.

Why Medical Exams Are Typically Required

Traditionally, insurance companies ask for a medical exam to assess your health. Think of it like a risk check. They want to know if you’re likely to live for 30 more years or just five. The healthier you are, the less risky you are to insure, and the lower your premiums.

What Is No-Medical-Exam Life Insurance?

Definition and Overview

No-medical-exam life insurance is exactly what it sounds like: a policy you can get without having to go through blood tests, urine samples, or a physical. You just answer a few health-related questions, and you’re good to go.

Types of No-Exam Life Insurance

There are several variations, including:

Simplified Issue Life Insurance

Guaranteed Issue Life Insurance

Group Life Insurance

Final Expense Insurance

Each has its own rules, but they all skip the lab coats.

Types of Life Insurance That Don’t Require a Medical Exam

Simplified Issue Life Insurance

This policy asks basic health questions but skips the lab tests. Approval is often within days. It’s great if you’re in decent health but want to avoid the hassle.

Guaranteed Issue Life Insurance

No health questions at all. Zero. Anyone can qualify, but coverage amounts are typically low—just enough for funeral and final expenses.

Group Life Insurance Through Employers

Many jobs offer life insurance as a benefit—no exam needed. You might be auto-enrolled or sign up during open enrollment.

Final Expense Insurance

Aimed at covering funeral costs, this is popular among seniors. No medical exam, simple process, and quick coverage.

How No-Exam Life Insurance Works

Application Process

Instead of visiting a clinic, you fill out a form online or over the phone. You’ll be asked about your lifestyle, medical history, and possibly your prescriptions.

Approval Timeline

This is where no-exam life insurance shines—you can get approved in 24-72 hours, sometimes instantly.

Premium Cost Comparison

Yes, it’s more expensive than fully underwritten policies. You’re paying for speed and convenience. But for many, it’s worth it.

Who Should Consider No-Exam Life Insurance?

People with Pre-Existing Conditions

If you’re worried that your medical history might raise red flags during an exam, this is a solid option.

Seniors or Older Adults

Older folks often have trouble qualifying for traditional policies. No-exam policies keep the door open.

Those Who Need Fast Coverage

Maybe you’re about to take a risky trip or close on a mortgage. No time for blood tests? No problem.

People Who Dislike Medical Tests

Let’s face it—nobody likes being poked with needles. If that’s you, this route saves a lot of discomfort.

Pros of No-Medical-Exam Life Insurance

Quick and Easy Application

You could apply during lunch and have coverage by dinner. It’s that fast.

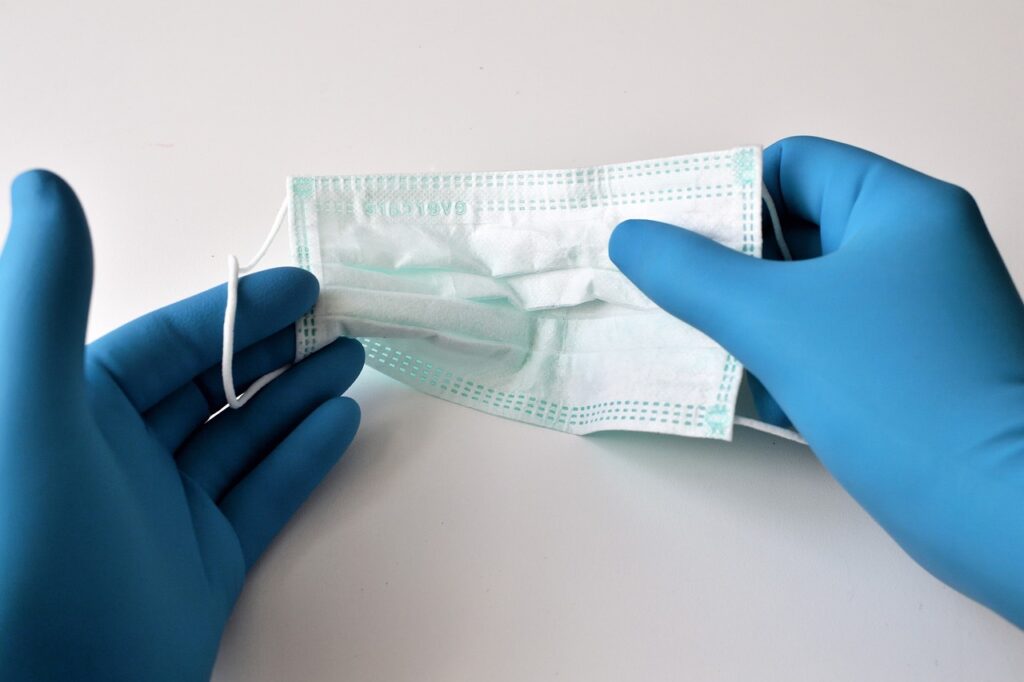

No Needles or Lab Tests

No awkward doctor visits. Just answer some questions and you’re done.

Fast Coverage Approval

No waiting weeks. Often approved in hours.

Cons of No-Medical-Exam Life Insurance

Higher Premiums

Because the insurer is taking a bigger risk, you pay more.

Lower Coverage Limits

You probably won’t find a no-exam policy with a $1 million payout. Most cap between $25,000 and $500,000.

Limited Policy Options

Fewer bells and whistles compared to traditional plans.

How to Choose the Right No-Exam Policy

Compare Quotes and Carriers

Prices vary widely. Always shop around.

Consider Your Health and Age

The younger and healthier you are, the better your rates—even with no exam.

Understand the Policy Terms

Know what’s covered and what isn’t. Read the fine print—twice.

What Insurance Companies Offer No-Exam Policies?

Top Providers to Consider

Some well-known insurers offering no-exam options include:

Haven Life

Bestow

Ethos

Mutual of Omaha

AIG

What to Look for in a Provider

Check their financial strength rating, reviews, and speed of approval.

Common Myths About No-Medical-Exam Life Insurance

“It’s Only for Sick People”

False. Many healthy people choose it for the speed and ease.

“Coverage Isn’t Reliable”

As long as you’re honest on your application, your policy is just as legit as any other.

Alternatives to No-Medical-Exam Life Insurance

Term Life with Accelerated Underwriting

This hybrid model uses data like prescription history to skip the exam but still offers lower premiums.

Employer-Sponsored Policies

Many offer low-cost coverage without exams. Take advantage if you can.

Tips to Get Approved Without a Medical Exam

Be Honest on the Application

Lying won’t help. If the insurer finds out later, your policy could be void.

Know What Questions Will Be Asked

Expect questions about smoking, alcohol, chronic conditions, and recent surgeries.

What to Expect After You Apply

Timeline

Approval can happen in less than 48 hours. Some policies even offer same-day coverage.

Common Reasons for Denial

Even without a medical exam, you can still be denied for things like serious chronic illness, risky lifestyle choices, or inaccurate information.

Real-Life Scenarios: Is It Right for You?

Case Study: Busy Professional

A 35-year-old executive needed fast life insurance before finalizing a mortgage. She got approved in 48 hours with a $500,000 simplified issue policy.

Case Study: Senior with Health Issues

A 68-year-old retiree with diabetes opted for guaranteed issue life insurance to cover final expenses—no questions asked.

Conclusion: Is No-Exam Life Insurance a Good Idea?

No-medical-exam life insurance isn’t for everyone, but it fills a crucial gap. If you need coverage quickly, have health concerns, or simply hate going to the doctor, it’s a solid option. Just weigh the pros and cons and shop smart. The peace of mind it offers? Priceless.

FAQs

Is no-exam life insurance more expensive?

Yes, typically. Since insurers take on more risk without a medical exam, they often charge higher premiums.

Can young, healthy people apply?

Absolutely. Younger applicants usually get better rates even with no-exam policies.

How fast is the approval process?

Most no-exam policies are approved within 24 to 72 hours—some even instantly.

What happens if I lie on the application?

Your policy could be voided. Honesty is key to ensuring your beneficiaries are protected.

Can I convert no-exam policies later?

Some policies allow you to convert to permanent insurance. Check with your provider for specific terms.